There is a saying that goes “ if you can’t grow it…. It has to be mined “ which refers to literally all the “stuff” we use in the world today. As you read this take a look around and you will see things that are grown ( your wooden desk perhaps ) and those things made of mined metals ( such as your phone, computer, car and TV etc. ) One of the things the world will be making more in coming years are electric vehicles which will be powered by batteries made of lithium, cobalt, manganese and nickel. These batteries are forecast to use a lot of nickel.

A sense of historical context is important when looking at the ups and downs of the nickel market over the years. Traditionally nickel metal and the associated equities market have seen boom and bust with prices fluctuating quite dramatically in response to short medium and long term trends that change the supply demand picture. The last big upward move in nickel prices culminated in 2007 when nickel traded at US$24 lb ( compared to US$5lb today). This was in response to dramatic increases in demand for the metal from China and perceived shortage of supply. During that time both junior miners and majors made dramatic share price moves until the global financial crisis and a supply response from Indonesian “pig nickel “ production drove prices down and nickel inventories up. The market buyouts of Inco, Falconbridge, LionOre and other nickel focused companies crystallized shareholder gains during this period as a result of the dramatic move in the price of nickel.

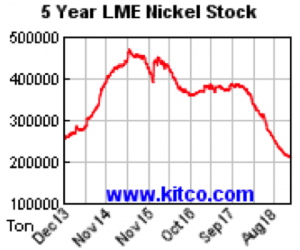

Nickel Inventories Falling for a Year

Recently the lower price of nickel has encouraged consumption in its traditional uses such as stainless steel and in turn has led to the start of a new cycle of inventory draw down. To this dynamic is added the use of nickel in electric vehicle batteries which are seen in many forecasts to become a major user of nickel and lead to a significant demand uptick. Eventually the decline in nickel inventories along with deficit markets will lead to a rising nickel price.

Grid Metals Exposure to Nickel

Grid Metals Makwa Mayville project in Manitoba has approximately $US2 billion of metal in resource at current metal prices, mainly nickel and copper. A National Instrument 43-101 Preliminary Economic Assessment study outlined a producing operation over a 15 year period and was completed in 2014. The mining and production processes proposed in the study are all standard processes used in the mining business for many years. We have little doubt when the price of nickel is rising again there will be tremendous interest in our project from the mining industry and investors. The sulphide nickel concentrate we would produce would be sold for smelting and refining – the traditional form of nickel production in Canada and which can produce nickel in forms for use in batteries.

Over the last few years with very difficult markets for junior miners we have striven to protect our assets - to maintain wnership and preserve their inherent value. Starting again this year we are undertaking steps to add value to our deposits through incremental but very impactful work activities such as new metallurgical test work to improve nickel recoveries and geophysical surveys targeting new drill targets underneath the known ore bodies.

We are closely watching as LME nickel inventories trend downward and usage of nickel in EV’s trends upward. So as we are not totally reliant on one project or commodity we have diversified and maintain exposure to other metals including lithium, tantalum, palladium and vanadium. We think this exposure to other commodities will be beneficial for shareholders in addition to our primary nickel focus.

The equity market for junior nickel explorers/developers can be an extremely dynamic place as evidenced by the last market boom – but you would not know if from the past several years. Look at a longer time frame to understand the potential that a longer view of the nickel market affords.